The recent announcement by the Malaysian government on the export duty exemption on palm oil has been lauded by many quarters. Exports of crude palm oil, crude palm kernel oil and processed palm kernel oil will all be exempted from duties from July through to December 2020. The move is part of the economic stimulus package to revitalize the palm oil industry in the wake of Covid-19 pandemic. The duty exemption will give Malaysian crude palm oil a price advantage over Indonesian CPO and could increase Malaysia’s exports by an additional 1 million MT of CPO.

As one of the largest vegetable oils buyers, Pakistan consumes about 4.5 million MT of oils and fats a year and domestic production is only able to meet 10% of the total requirement, hence resulting in the country relying heavily on imports to meet about 90% of domestic demand. Palm oil accounts for 94% of total imports of oils and fats. The country imports over 3 million MT of palm oil every year out of which refined palm oil has a share of 90% – 95%. Despite of having a well-established physical refining industry, the imports of CPO remain very low and the reasons for this trend will be discussed in this article.

Physical Refining Industry in Pakistan

There are 19 physical refineries in Pakistan with an accumulated installed capacity of 1.5 MMT. Most of these refineries are installed at Port Qasim Authority which connects them directly to the jetty and inward supply chain. However, due to economic infeasibility and lack of duty-free CPO from Indonesia and Malaysia, most of these refineries are either shut down or are operating at a very low capacity. On average, the imports of CPO in Pakistan remain in the range of 150,000 – 180,000 MT which translate into the capacity utilization of 10% – 12% only. In 2019, the CPO imports in Pakistan increased to 376,233 MT, recording a significant increase of 91%. This was mainly due to the availability of duty-free CPO from Malaysia and Indonesia throughout 2019.

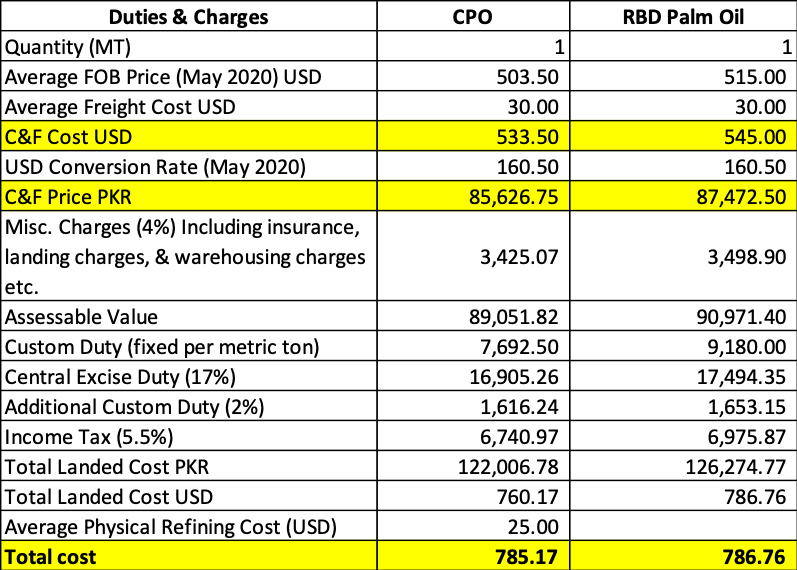

Although the imports of CPO in Pakistan have registered a significant increase in the last 5 years, the overall import volumes are still extremely low when compared with the total installed refining capacity in Pakistan. This is primarily because of the lower duty advantage given to crude oil vis-à-vis RBD palm oil and high refining cost at local refineries. Given below is a comparison of landed cost of locally refined RBD palm oil (produced with CPO) and imported RBD palm oil.

Landed Cost Comparison

The above calculation was done on the average FOB price of CPO and RBD palm oil reported by MPOB in the May 2020. Despite of the price spread of USD 11.5, the landed cost of CPO in Pakistan was approx. USD 26 cheaper than RBD palm oil, however, after including the average refining cost of USD 25 per MT, the locally produced RBD palm oil was almost at par with imported RBD palm oil.

Price Spread of CPO & RBD Palm Oil

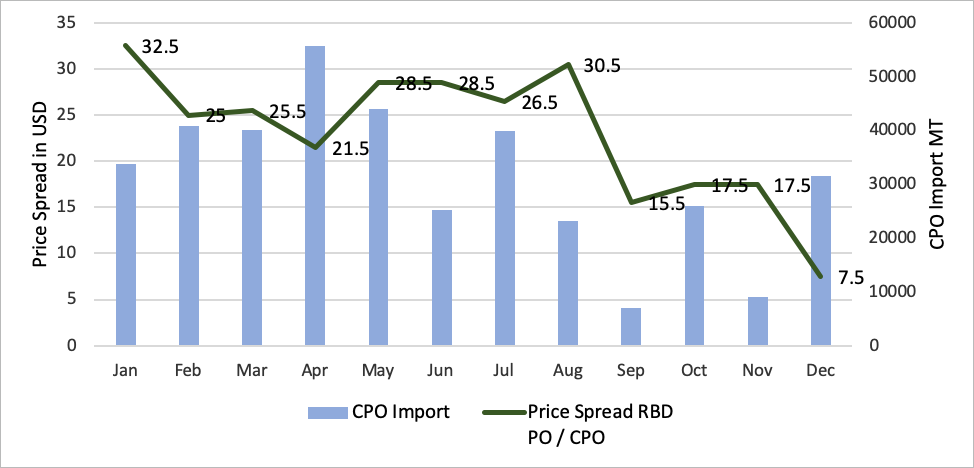

Price spread between RBD palm oil and CPO dictates the viability of CPO imports in Pakistan. Keeping in view that the duty on CPO is only USD 10 lower than that of RBD palm oil and the average refining cost varies between USD 20 – 25 per MT. It is only viable for the local refining industry to import CPO when it is at least USD 20 per MT cheaper than RBD palm oil. Following charts show the relationship of the price spread and import volume of CPO in Pakistan in 2019 and Jan-May period of 2020.

CPO Imports & Price Spread (Jan – Dec 2019)

CPO Imports & Price Spread (Jan – May 2020)

The spread between the price of CPO and RBD palm oil for most of 2019 remained above USD 20 which, coupled with duty free export of CPO resulted in 91% increase in the volume of CPO imported when compared with 2018.

During the period of Jan – May 2020, the spread between CPO and RBD has come down to drastically and has even gone into negative values in 2 months. During these months, export duty on CPO was also applicable since the price stay above the threshold levels. These factors resulted in a sudden decline in the imports of CPO in Pakistan.

Outlook for CPO Import in 2H20

In normal circumstances, Malaysian CPO also must compete with the discounted price of Indonesia RBD palm oil, which at times is either at par or lower than the price of CPO offered by Malaysian suppliers. However, in the past 3 months, the prices offered by Malaysian suppliers have been almost at par with those of their Indonesian competitors. The abolishment of export duty on CPO in Malaysia has triggered a lot of interest among the physical refiners in Pakistan. If the price differential between CPO and RBD palm oil reaches its usual level of USD 20 – 25 per MT, then Pakistani refining industry is ready to lift between 30,000 – 40,000 MT of CPO every month. However, at the current price differential of USD 5 – 10 per MT, the CPO refining is not viable for local physical refining industry.

Prepared by Faisal Iqbal and Azriyah Azian

*Disclaimer: This document has been prepared based on information from sources believed to be reliable but we do not make any representations as to its accuracy. This document is for information only and opinion expressed may be subject to change without notice and we will not accept any responsibility and shall not be held responsible for any loss or damage arising from or in respect of any use or misuse or reliance on the contents. We reserve our right to delete or edit any information on this site at any time at our absolute discretion without giving any prior notice.